Increase in business rates ‘will contribute to fewer shops and fewer jobs’

When September’s Retail Price Index (RPI) figures are published next month they will be used to determine the uplift in business rates next April. As a clear indicator of what to expect, the RPI numbers for last month reveal that inflation continued to rise in August to 3.9 per cent.

Using this figure and the fact that the rate of inflation has already accelerated to 3.9 per cent from two per cent in September 2016, the British Retail Consortium (BRC) is predicting that this coming September’s RPI is likely to be at least four per cent.

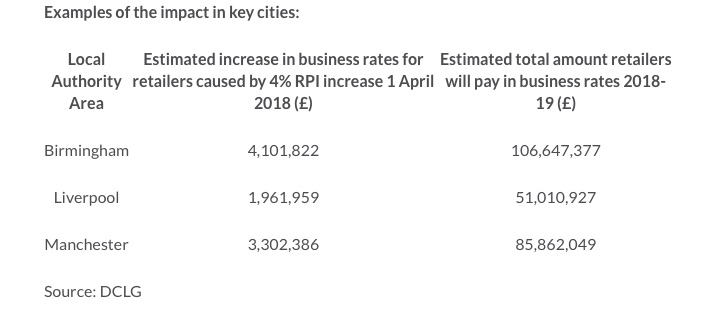

The BRC therefore predict the rise will push up business rates bills for retailers across the country – who account for a quarter of all rates paid – by a potential £280 million next April.

Commenting on the likely spike in business rates bills, Tom Ironside, Director of Business Regulation at BRC said: “Retailers are staring down the barrel of a hefty £280 million hike in their business rates bills from next Spring.

It is highly questionable whether communities across the UK can afford a spike in business rates of this scale and any resulting loss of commercial investment will contribute to fewer shops and fewer jobs. Nearly one in every 10 shops currently lies vacant and those in economically-vulnerable communities in particular remain persistently empty, limiting the chances for these places to thrive.

“With the economy slowing, consumer spending facing headwinds and retailers responding to profound changes in shopping habits, the prospect of a further investment-sapping tax rise of this magnitude is deeply worrying and will only serve to make life tougher for high streets.

“Government should knock on the head any notion of a bumper rise in rates next Spring and work with the retail industry and business to put the rates system on a more affordable and sustainable footing. This would increase retailers’ confidence about investing in new or refurbished shop premises.”

Recent Posts

Recent Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- November 2020

- September 2020

- July 2020

- May 2020

- April 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017